Excited to start hiring a Filipino virtual assistant (VA) to help with your business? Before you publish that job hiring post, you just might want to make sure you’ve ticked off everything in the VA hiring checklist.

First and foremost, if you are hiring a VA through Philippine virtual assistant agencies, then there’s no need to think about how to pay virtual assistants in the Philippines. You’ll just be paying the agency and they’ll be the one to disburse the payment to your VA.

But if you are hiring a VA directly, there are some steps you should follow. If you haven’t already, make sure to clearly write down the job scope of your Filipino VA. This will not only make the hiring process smoother but also make figuring out how much salary to pay your Filipino VA much easier.

And the last thing on that checklist is what’s in this guide. We’ll be covering the best methods of how to pay Philippines-based virtual assistants that are practical for both you and your employee.

Table of Contents

The Best Payment Method for You & Your VA in the Philippines

For employers like you, the best payment methods for paying your Filipino VA are those that make it easy to process transfers and those that have smaller fees, if any at all. Depending on your agreement with your Filipino VA, you will be processing payments every week, or fortnight, or month. So, it’s important to choose a payment method that is both convenient and accessible.

As for your prospective VA, their main concern would be getting the payment in a timely and reliable manner. Next, Filipino VAs would prefer payment methods with the least fees and the highest currency conversion rates. Taking these into consideration when selecting your payment method will make your VA value you more as a client.

Wise, Payoneer, and Paypal are among the most popular methods. Let’s look into the details of each one with these criteria in mind.

Wise: Best for Easy Transfers & Cheapest Fees

When you go to Philippine online VA groups, most Filipino VAs swear by Wise. Why? Because it’s very easy to get a local bank account number there for countries like the USA, Australia, Canada, and the UK. So, there’s no extra work involved for most employers since they can just do a regular bank transfer to that account.

Of course, the very low fees are appealing too. The fees can cost as much as 10 times less than other popular payment methods. So, for Filipino VAs, that’s more money to take home to their families.

Don’t worry if there’s no Wise bank account available in your country. There is an alternative method that takes just a little bit of effort on your part.

You can open an account in the Wise platform and top up money to it. Wise accepts over 140 currencies on its platform. Then you can just convert it to the currency needed for your Filipino VA’s salary, whether that’s in USD, CAD, AUD, or even PHP.

Disadvantages: Setting up a Wise account can feel convoluted.

Payment Process: You just need to do a local bank transfer to the account number that your VA will give you. Alternatively, you can top up a Wise account, convert money to the desired currency, and transfer it to your VA’s Wise or bank account.

Sending Cost: Just local bank transfer costs, if there are any for your bank. But if you are sending from your Wise account to another Wise account, there’s a variable or fixed fee depending on the currency that you can check using the Wise calculator.

Currencies: A local bank account can be created in the following currencies – AUD, CAD, EUR, GBP, NZR, SGD, USD, and a few others. Meanwhile, the Wise account itself accepts over 140 currencies.

Website: Wise.com

Mobile App: Google Play | App Store

Payoneer: Best for Ease-of-Use & High Volume Transactions

Featuring an intuitive platform, Payoneer’s strengths are in making online transfers as easy as possible for business owners. It features multiple payment options, flexible scheduling, and detailed tracking. So, you are always on top of your payment processing game.

It’s quite similar to PayPal in terms of sending costs, but Payoneer has a much simpler fee structure. Though, both of them have more expensive currency conversion fees than Wise.

Payoneer also provides cost savings for mass payments done through the platform. That won’t be of use to you right now, but maybe it’s something you can consider once your business grows.

Disadvantages: Cost savings are minimal if you don’t have a high volume of transactions.

Payment Process: Both you and your VA need to create a Payoneer account first. Then you can pay your VA via Payoneer to Payoneer, bank transfer, or credit card.

Sending Cost: Payoneer to Payoneer is free, bank transfer is 0 to 1%, and 3% via credit card.

Currencies: The Payoneer account itself can process transactions in 150+ currencies. Alternatively, a local bank account for your VA can be created in the following currencies – USD, GBP, EUR, AUD, CAD, SGD, JPY, and a few others.

Website: Payoneer.com

Mobile App: Google Play | App Store

PayPal: Best for Speed

Offering accessibility and security for online payments, PayPal was the go-to choice in the early 2010s. It’s very easy to set up a PayPal account and also to send money worldwide. But with the increasing availability of alternative payment platforms, PayPal is now just a decent option to those that offer more competitive fees.

But there is one area in that PayPal still remains unmatched, and that is speed. Payments from PayPal to PayPal accounts happen almost instantaneously. This eliminates any worries that a payment may not have gone through.

But the sending fee being covered by the recipient puts both the employer and the VA in an awkward position. The VA may want to negotiate with the employer to cover that fee. So, you may need to talk this over and make adjustments to the salary.

Lastly, PayPal’s currency conversion fees are also quite exorbitant. So, most Filipino VAs prefer other payment platforms as much as possible.

Disadvantages: Expensive (and complex) fee system.

Payment Process: You can use your PayPal balance or a credit card to send money to your VA’s PayPal account.

Sending Cost: USD 0.49 + 4.99% international processing fee per transaction covered by the recipient.

Currencies: Only 25 currencies supported (USD, PHP, CAD, AUD, etc). You can view the full list here.

Website: PayPal.com

Mobile App: Google Play | App Store

How to Pay Virtual Assistants in the Philippines: 3-Step Guide

Now, with a better idea of the strengths and weaknesses of each payment method, let’s go through the steps of actually choosing the best platform for you and your Filipino VA.

Step 1: Decide on a Payment Process Based on the Work Arrangement with Your VA

It’s important to have regularity in the payment process to prevent any confusion and uncertainty for both you and your Filipino VA. So, you should already have a good idea of what your work arrangements are before you even consider payment options.

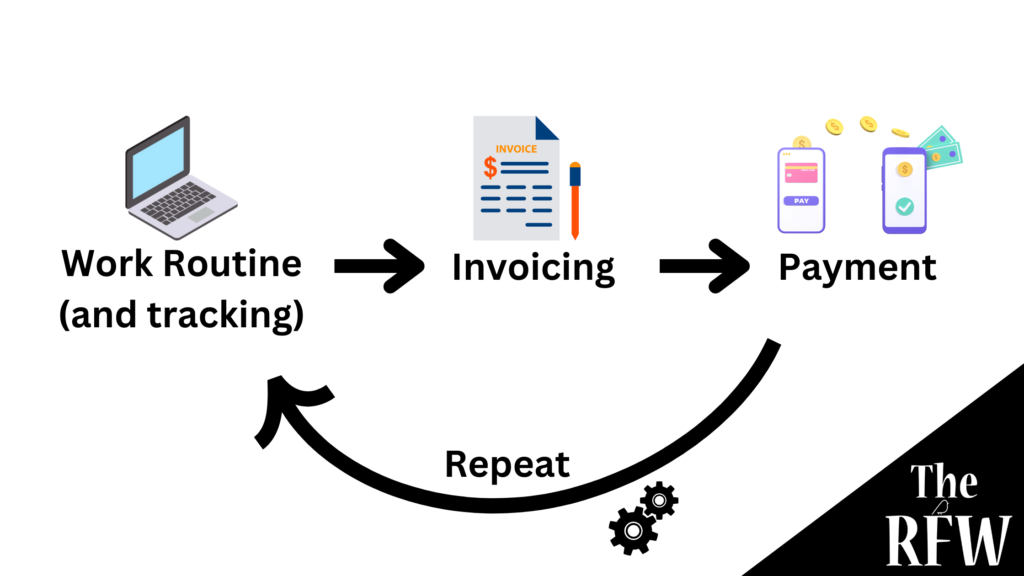

A typical work arrangement and payment process may look like this:

In this work arrangement, your VA will be paid after they complete a set work routine. The VA will then invoice you after completing the work. After receiving the invoice, you then pay your VA. Then the process just repeats itself.

Of course, there are other factors that might affect the typical work arrangement. Will your VA be paid at a fixed rate or variable rate? How will work be tracked? Are any tasks or results that might change how much you pay and when you pay your VA?

If there are, then make sure to take those into consideration when deciding on a payment process. You can then set a regular payment schedule with those in mind.

Step 2: Agree on a Payment Schedule

The payment schedule is your agreement with the Filipino VA regarding how often they will be paid for their work. This is typically done weekly, bi-weekly, or monthly depending on what’s agreeable for both you and your VA.

More often than not, the employer (you) will be the one who has the leverage in this conversation. And since it’s easier to just do payment processing once a month, most employers would like to follow a monthly schedule.

However, that arrangement might not be agreeable to some VAs for two reasons. First, the VA may need more frequent payments due to having urgent bills to pay. Second, in terms of doing work online, most agree that there is a higher risk of not getting paid in longer payment cycles. So, if you decide to push this arrangement, there can be a risk of your VA looking for another job.

That’s why bi-weekly payment schedules are arguably the best compromise for both parties. But at the end of the day, it’s your choice.

Step 3: Decide on a Payment Method

With the payment process and schedule in mind, it’s now time to choose the best payment method for you.

Wise is an excellent choice since you can just get your VA to set up an account in your local currency. Then, it’s as easy as making regular bank transfers to that account based on your agreed-upon payment schedule.

But if Wise does not have your currency available, you can always create a Wise account yourself and do a currency conversion there. Then, you just send the converted amount to your Filipino VA’s Wise or bank account.

On the small chance that Wise doesn’t support your currency, then you’d have to choose another method. You might want to look into Payoneer, the platform with the most accessibility in terms of currencies.

If you want to keep it simple, just choose the alternative that is most accessible for you and your VA. But the method you chose may have long-term effects so it’s typically recommended to do your research carefully.

For example, some methods, like PayPal, charge a percentage to the receiver when you send money to them. You have to decide if you or your VA will be the one to shoulder fees like that. Otherwise, it might affect your payment process.

Frequently Asked Questions

How much is a fair salary for virtual assistants from the Philippines?

Typically, entry-level virtual assistants have a salary range from 2.50 USD to 5.00 USD per hour. This rate is for virtual assistants mainly handling administrative and clerical tasks. This rate will go up once more specialized tasks, such as social media management or graphic design, are involved.

But with the rising costs of living in the Philippines, this salary range may not be as competitive as it was before. If the job responsibilities of the Filipino VA you want to hire are crucial or specialized, then you might want to consider a more attractive salary package. You can increase the base salary or add benefits to the package to make it more appealing.

How do I hire a virtual assistant from the Philippines?

There are two methods to hire a Filipino virtual assistant: (1) through one of the many Philippine virtual assistant agencies or (2) by hiring them directly. There are advantages and disadvantages to both methods.

The advantage of hiring through a VA agency is that they can screen and train your VAs for you. You also don’t have to worry about your VAs’ payment processing and government benefits. On the flip side, going through an agency is usually much more expensive.

Meanwhile, hiring directly means you have much more control over your Filipino VA’s salary. But you have to be the one doing the recruitment, screening, training, and payment processing. But since there’s no middleman, it’s also much easier to absorb a high-performing VA into your company.

There are also VA agencies, such as MultiplyMii and Support Shepherd, that you can work with to headhunt a Filipino VA that will work directly for you. You get the benefit of their recruitment experience to work for you so you can avoid the headache of screening and training applicants yourself. Also, you can also opt-in to their payroll and account management solutions.

To help you decide on what method is better for your specific situation, please see the article “How to Hire a VA from the Philippines”